Learning how to make financial projections is one of the most important things for the survival of a startup. But many thought that this is a common practice used by big enterprises only.

Now it’s time to rethink that idea.

Financial projections are essential for businesses of all sizes, including startups, especially when markets take an unforeseen shift, like the one induced by the COVID-19 outbreak.

It will help you get your hands on actionable data, allowing you to make informed decisions, implement changes, readjust your product-market fit strategy, and grow your business in the right direction.

Learning how to make financial projections can help keep your startup afloat and determine the long-term viability of your business.

Without any further ado, let’s see what are the key benefits of making financial projections.

Channel your cash in the right direction

Cash is one important asset that allows you to grow, thrive, and survive hard times.

Learning how to make financial projections during a crisis will help you identify the most vulnerable business processes and make informed decisions about how much cash to allocate to each one of them.

With the ability to channel cash in the right direction, you will keep your bottom line healthy. There are several factors to include in these forecasts:

- Lost clients and potentially lost clients

- The total sum of delayed payments

- The potential closure of an office

- Weekly and monthly business costs

These figures will help you determine whether you need additional funds to keep your doors open. If you have sufficient funds, you can use surplus cash to explore new opportunities in the market.

The cash flow forecast will also enable you to test different scenarios such as the impact of furloughing employees, deferral of VAT, and various loans and repayment schedules.

Evaluate new business opportunities

With a cash flow forecast, you will find out whether you have cash for new investments and how much you can safely invest.

From that point on, building financial projections can help you assess the profitability of every opportunity.

Projections will help you assess the financial viability of any and all opportunities you discover. When you have projected expenses and income, it becomes significantly easier to make a business decision.

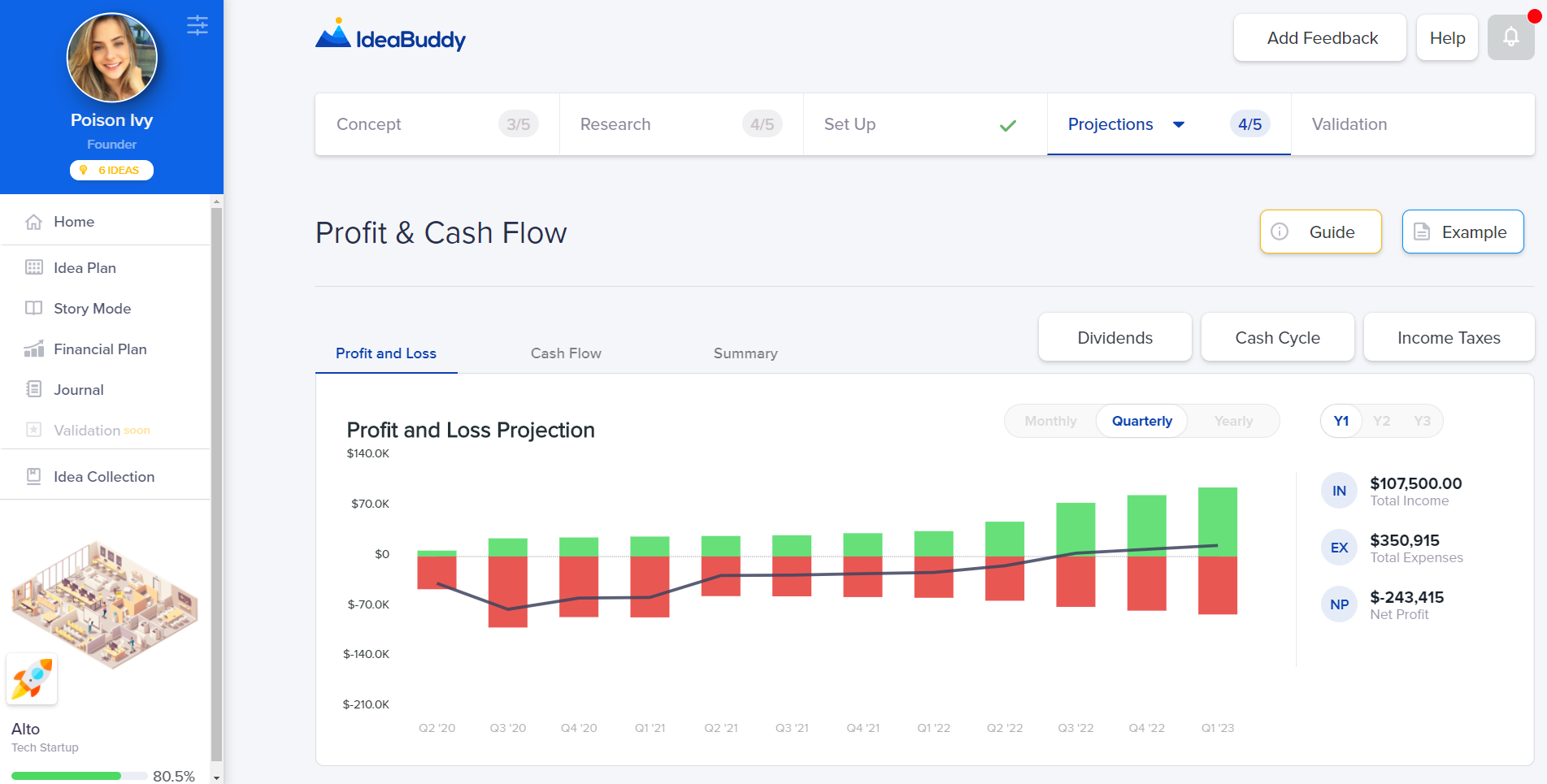

Project your financial performance

There is no better tool than financial performance analysis for projecting where your business will stand in the future.

To be accurate, financial performance analysis has to take all measures into account, including those found in the cash flow statement, income statement, and balance sheet.

We’ve already addressed the cash flow analysis, so let’s take a closer look at the income statement and balance sheet.

The income statement provides you with insight into all your operations for the current year.

You will see your sales, revenues, and net income. Comparing your current year’s data to the previous year can provide actionable insights and put you in a position to adopt strategies and improve the financial performance of your company.

If you were managing your company through the financial crisis of 2008–09, now would be a good time to dive into those numbers and see what you did to keep your firm alive.

Future-proof your business

The most common reason for shutting the doors of any business is hitting a wall, and hitting a wall is usually about running out of cash. This means that the deliverables of financial projections will enable you to future-proof your business.

You can’t make sound financial decisions unless you know the exact expenses of all your ongoing projects. Once you determine how much money your business will need, you can start assessing various scenarios.

You can project the impact of certain business decisions. For instance, if you are considering putting some of your projects on hold and furloughing employees, you can project how much money you will save and potentially lose.

Making financial projections can also help you explore various opportunities for securing the required financing and examine your company’s capacity to maintain such operations.

Make different scenarios

There was nothing you could do to prepare your business for these unexpected, unprecedented times. Creating financial projections will help to highlight all facets of your business and mitigate future risks. Its benefits are rooted in your ability to forecast specific scenarios relevant to your business, target market, and customers.

Here are some ideas for the scenarios that you can apply to your business to get valuable insights.

1. Changes in the supply chain

Projecting changes in your supply chain is a must in the face of disruption. You will have to assess the entire chain and identify the suppliers that are crucial for maintaining your business operations.

This will help you distinguish essentials from non-essential payments.

Feel free to enter new measurements into your cash flow and apply forecasting to discover how the changes reflect your revenue and spending. You should continue to juggle the numbers around until you find the best scenario in terms of keeping your business operational.

2. Staff furloughing

Should you furlough some of your employees or not? If so, how many of them should you send to a temporary leave, and how much money can you save? Create different financial projections to help you answer all these questions.

Test various scenarios to discover the best possible outcome for your business and employees. Take key roles into account as well. Maybe you don’t need all of them on the payroll at the moment.

Don’t forget to factor in government programs and grants. Employee reimbursements come with a cap. Discover exactly how big the grant is for furloughed employee’s salaries to plan your finances.

Also, you should expect to see some time lag between receiving the grant and paying furloughed employees. This time lag can be fatal for your budget, so you are strongly advised to address it in your calculations.

3. Business loans

Businesses are offered several “good-deal” loans to cushion the blow of the negative cash-flow impact.

Calculate them into various scenarios to determine whether you can afford them or not. Surviving the financial crisis doesn’t mean that your business will manage to survive or thrive once the crisis is over, and you need to start covering payments.

Read Also: Startup Funding Sources – The Complete Guide

4. Deferring vs. not deferring value-added tax

Finally, many governments have offered VAT privileges to businesses affected by negative market conditions. Do you defer VAT or not? Without evaluating both scenarios using by building financial projections for your startup, any answer is just vague guesswork.

How to make financial projections: Conclusion

Learning how to make financial projections for your startup is a practice you should definitely take into consideration. There are plenty of tools that can help you with crafting startup financial projections, validate your business ideas, and reduce investment risks. What we can recommend is to try with IdeaBuddy.

To be on the safe side, and forecast as many scenarios you can. This practice will provide you with enough data to be able to make the right business decisions.