One of the biggest factors of a startup’s success is a thorough business plan that includes reliable financial projections for startups.

The more accurate forecast you make, the higher is the probability of attracting investments.

In this guide, we’ll give you answers to these questions:

- What is the main purpose of making financial projections for startups?

- What are the two methods of creating financial projections?

- How to make realistic assumptions?

- What is the purpose of financial statements?

- How to create a starting advantage?

The main purpose of making financial projections for startups

Spending time making financial projections can help you in multiple ways.

Internal financial planning

Let’s say you’re planning to start a business. In this case, financial projections help you plan your startup budget, assess when you can expect the business to become profitable, and set benchmarks for achieving financial goals.

If you’re already in business, creating concise financial projections every 6 or 12 months will help you in keeping your startup on the right track.

Seeking external funding

When you are in this stage, creating financial projections for startups will help you in convincing potential investors that your startup will not only be profitable but also will have a good return on investment.

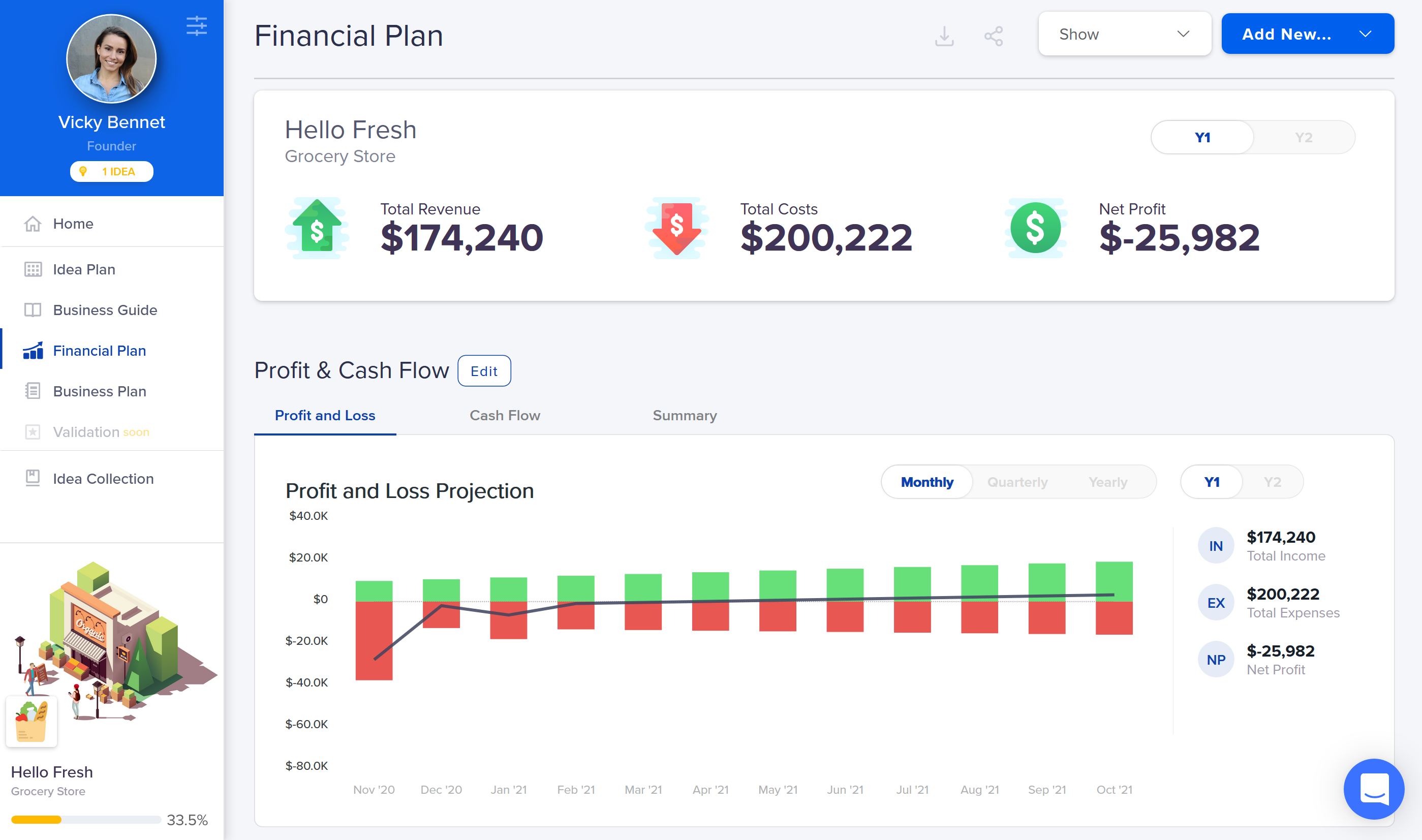

If you’re not financially savvy, IdeaBuddy has a cool feature called Financial Plan, which will help you with calculating revenue and growth, startup expenses, loan payments, profit margin, cash flow, and other important business KPIs.

Now, let’s start with the basics!

Two main approaches of creating financial projections for startups

There are two main methods of making financial projections for startups – top-down forecasting and bottom-up forecasting.

Top-down forecasting

Using the top-down approach, you work from a macro/outside-in perspective towards a micro view. Typically industry estimates are taken as a starting point and narrowed down into targets that fit your startup.

In essence, the top-down model helps you define financial projections based on the market share you would like to achieve within a reasonable time. The easiest way to precisely perform top-down forecasting is the TAM SAM SOM model.

The TAM SAM SOM model catches the market size on three levels:

- TAM (Total Available Market) the section of that market you approach with a specific offering (your startup niche) adjusted for specific geographical reach.

- SAM (Serviceable Available Market) – The part of SAM you can realistically capture, given the existing competition.

- SOM (Serviceable Obtainable Market) is equal to your sales target. It outlines the value of the market share you aim to achieve.

Based on the sales targets you set using the TAM SAM SOM model, the next step is to estimate all costs needed to build or deliver your product or service.

Also, all expenses needed to perform sales and marketing, research and development, and general and administrative tasks for your startup to stay alive.

When estimating these, keep in mind that you need to aim for profitability within a reasonable timeframe.

Bottom-up forecasting

The top-down approach’s pitfall is that it might seduce you to forecast too optimistically, especially sales estimation. Therefore, it will be best to complement the top-down model with the bottom-up approach.

Opposite to the top-down method, the bottom-up strategy begins with an inside-out view.

With the bottom-up approach, you estimate expenses, costs, revenues, and investments based on the research and assumptions. The pitfall of this method is that it might fail to show the confidence needed to convince others of your startup potential.

If you are a startup founder and are looking to raise funding, the bottom-up strategy might not do the trick.

Keep in mind that most investors usually expect startups to grow fast and gain significant market share quickly. The bottom-up approach might fail to indicate that.

Which method to use?

It is almost impossible to estimate factors such as virality or word of mouth with the bottom-up approach.

Further, the whole reason why external financing is needed is often to expand capacity and grow faster than a startup would do organically.

That is why when you build your startup’s forecast, you need to combine both the bottom-up and top-down methods – especially when you plan to achieve a strong growth curve utilizing external funding.

For the best startup financial estimation, utilize the bottom-up method for your short term forecast 1-2 years.

And in the top-down method for the longer term 3-5 years ahead.

This way, you can complete and secure your short term objectives very well. And your long-term targets will show the desired market part and the ambition investors are searching for.

How to make realistic assumptions

No matter what approach you choose to build your startup’s financial model, it is essential you can prove your numbers with realistic assumptions.

The main problem is that previous data is not available, so you need to find a way to present the proof behind your estimated numbers.

When you start discussing with investors, they are interested in knowing the argumentation behind your numbers. They are considering putting money in your startup, so you do not want to give them the feeling you are selling baloney!

Assumptions can be anything that validates your numbers:

- Market research

- Web search volume

- Contracts with suppliers

- Pricing validation

- Conversion rates

Okay, that is more than enough to get started.

Let’s get to it, then!

We will start with questions that reflect the challenges behind creating financial projections for your startup.

Read also: How to Make Financial Projections

Statements included in financial projections

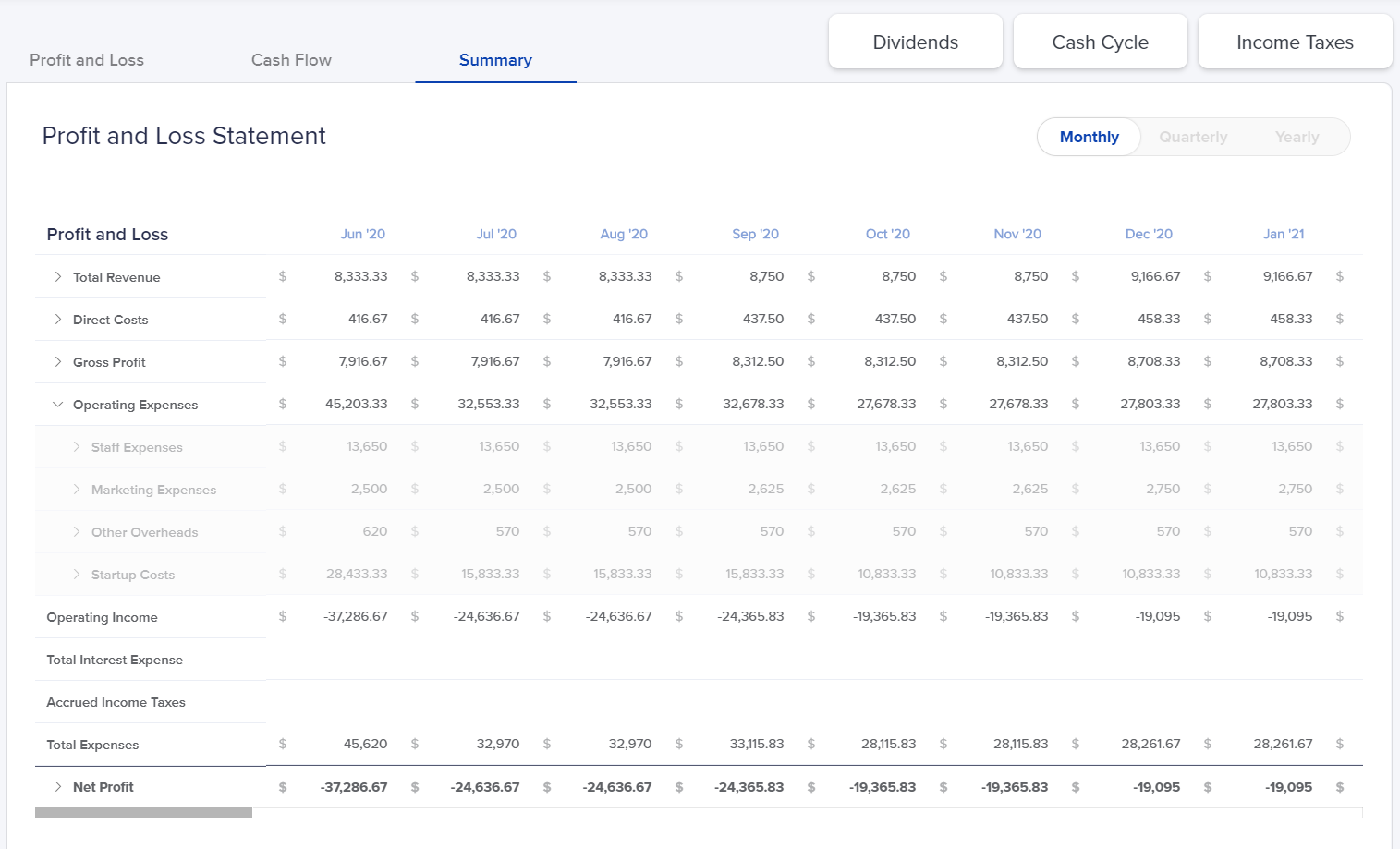

Financial projections combine three financial statements that are necessary to better understand the financial performance of your startup.

Income statement

It is also known as a profit & loss statement and it focuses on the startup revenue and expenses generated during a particular period.

The four estimates included in the income statement are:

- Revenue

- Expenses

- Gains

- Losses

Combining these four gives you the net income, which is a metric for your startup’s profitability.

In the first year, you need to create a monthly income statement.

The second year, quarterly statements, and in the years to come, you will just need an annual income statement.

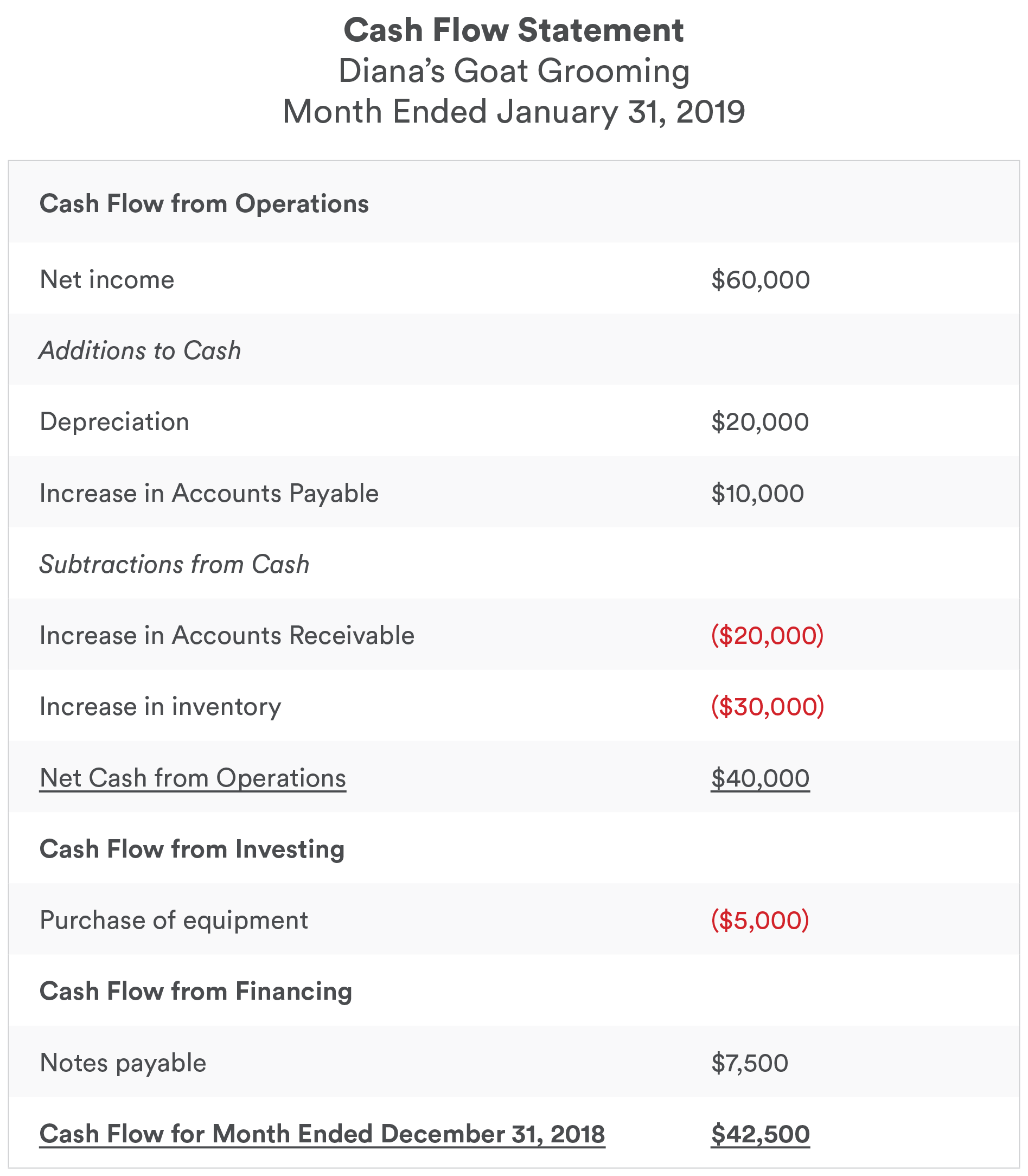

Cash flow statement

A cash flow statement aids you in understanding how startup operations will run.

It will show more detail on how much money will flow into and out of your startup business in income and expenses.

A cash flow statement’s three fundamental components include cash flows from operating, investing, and financing your startup activities.

- Operating activities include any changes made in cash flow, accounts receivable, inventory, depreciation, and accounts payable.

- Investing activities include cash inflows for sales of assets and cash outflows for any fixed assets, such as property and equipment.

- Financing activities show a business’s cash sources from either investors or banks and expenditures of cash paid to shareholders.

The cash flow statement and income statement are both tightly connected by net income.

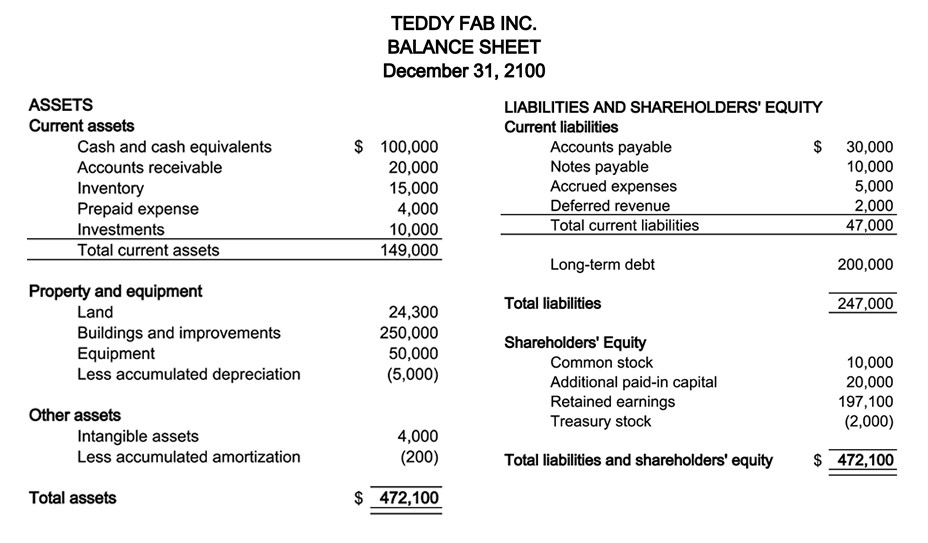

Balance Sheet

A balance sheet presents a general overview of your startup’s financial health. It includes assets, liabilities, and owners’ equity in a specific period of time.

Here is an overview of each balance sheet component:

- Assets are resources with a financial value that a startup business owns and estimated to provide a future benefit. That includes generating cash flow, enhancing sales and reducing expenses. Assets usually include property, inventory and cash.

- Liabilities are, in general, obligations to the third party. They are monthly expenses that occur during business operations. It usually includes accounts payable and loans.

- Owners’ equity is any amount left over after paying all liabilities. It’s usually categorized as retained earnings: the sum of all net income earned minus all paid earnings since inception.

Balance sheet has two parts. You have assets on one side and liabilities and owner’s equity on the other side. Projecting three years into the future could make it possible for you to estimate a break-even point.

That is the moment when your startup ends performing at a loss and begins to turn a profit.

The break-even point for most of the startups is in about 18 months. However, that threshold will fluctuate based on your business model, industry and niche involved.

How to create an advantage

It can be a real challenge to make financial projections for startups when they are not even launched.

At that point, you do not have any real data to give you a better understanding of future projections.

Still, with a little market and industry research, you will have a lot of data to work with, helping you to create realistic financial projections for startup business.

Before striking out on your own, consider the industry you have been working in and have experience working in.

That way, you will have a better idea of what realistic financial projections look like, what growth rate is ideal, how long it will take to scale, and what profit margins are normal within your industry niche.

Final words: Financial projections for startups

Potential investors know that the financial projections for startups can’t be 100% accurate, but you need to make sure they are realistic.

Lending institutions and investors have seen too many entrepreneurs who are overly optimistic about their businesses.

So as a future startup owner, you need to make sure your projections are reliable and your business has the capacity to grow.

There we suggest you try IdeaBuddy for free. Our app can help you create detailed financial projections before you start investing in it.

IdeaBuddy is an easy-to-use tool that puts some color into financial planning. Also, it comes with a step-by-step guide and relevant examples. This means that you don’t have to be a business guru or financial whiz to make financial projections for startups!

So, what are you waiting for? Start making your financial projections today and pursue your dreams with passion, since they will not come to pursue you!